06

16

06

Leave your bank, join a credit union

When I got married, I was reluctant to leave my bank, which is one of Canada’s enormous, super-profitable savings-sucking behemoths, in favour of the credit union where my wife had her account.

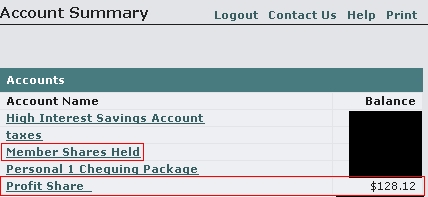

As you’d expect, she won that argument, and of course, she was also right:

When was the last time your bank PAID you money instead of screwing you for every last cent you’ve got?

June 19th, 2006 at 5:45 pm

so what is the interest rate on your savings account?

Please elaborate on the whole credit union vs. big bank statement :P

June 21st, 2006 at 8:08 am

I can’t remember, something competitive with ING though. In general, our credit union is a lot easier to deal with. We got a single person assigned to our account and when we have issues we deal directly with her, she’s flexible about things like loans and mortgages and is willing to give us the benefit of the doubt. This is in marked contrast to banks, who always seem as though they’re doing you a favour by taking your money.

But the best thing about it is that they’re not there to suck our money. Low fees, high interest on savings, low interest on loans, and they share the profits. The mortgage we got has a slightly higher rate than some bigger bank competitors – by about 1/4 of 1 percent – but with the profit sharing it works out the same, and I’d rather deal with the credit union.

Because I have a line of credit with TD, I couldn’t say goodbye to them completely. The other day I received a letter in the mail. They raised my interest rate on the line of credit by a couple of percentage points. This raise is apparently totally arbitrary, no explanation was given for why they decided I should pay more interest. This is a bank that had $365 billion in assets as of October 31, 2005. But they really need a few more hundred dollars from me.